Introducing PlutoPay

Finances can be complicated, and money moves quickly these days.

PlutoPay is for users who want to gain better control of their finances through informed spending, secure savings, and intentional investments.

Understand

The Problem Statement

Online Shoppers need a way to take control of their finances in a rapidly growing e-commerce industry because they deserve financial literacy and secure transactions.

We will know this to be true when we see users improve their daily financial status through budgeting, easy access to their accounts, and protected purchases.

The Hypothesis

The best possible solution for my users’ needs is a finance app that securely guards their money while educating them about healthy financial habits to make informed purchases.

By giving users the tools to analyze their spending habits, they can create budgets, investment portfolios, and empowered decisions around where their money goes.

How PlutoPay can help

PlutoPay is for users who want to gain better control of their finances through informed spending, secure savings, and intentional investments.

My mission is to provide them with the education, the support, and the technology to transform their financial health.

By keeping user security and satisfaction as my primary motivations, PlutoPay will satisfy a huge demand in the market and make a lasting impact on our users.

The Design Strategy

Security

Safeguarded payments without needing to pull out a card at checkout

Education

Financial auditing, goal setting, and guided savings plans to improve financial literacy

Connection

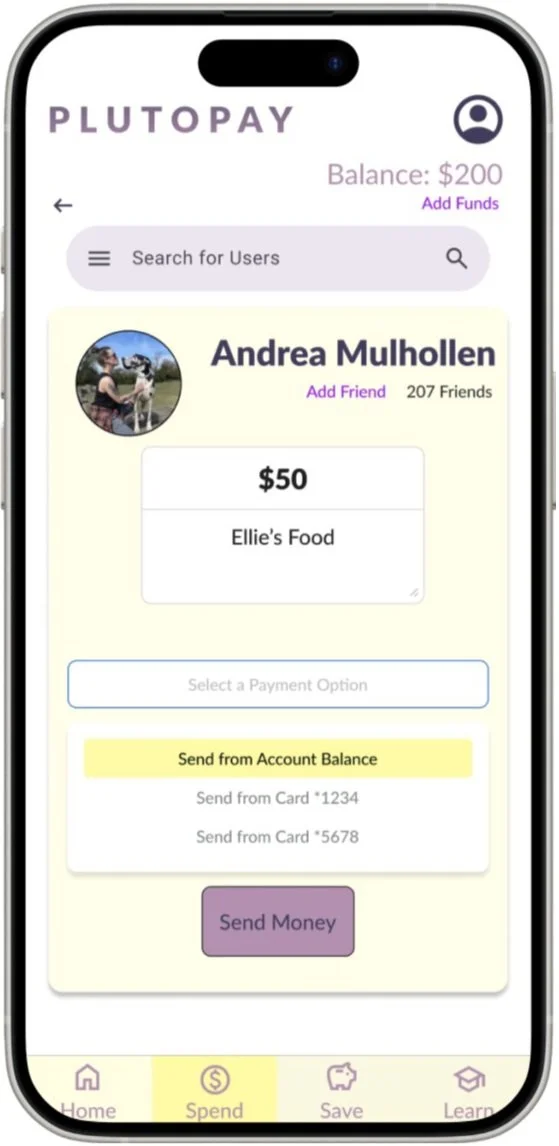

Sending and receiving transactions with Person-to-Person money transfers

-Quotes from the User Interviews

Analyze

User Interview Goals

To identify what people report as their biggest area of opportunity

To understand my users’ financial education to better meet them where they are

To determine tools that an app could offer to meet their needs

What We Learned

User Surveys

8 participants

6 women, 2 men

Age Range: 18-65

What They Want

Smart savings

Secure transactions

Transparency with data

Impulse control

To “get ahead”

User Interviews

5 participants

3 women, 2 men

Age Range: 27-39

What They Need

Accountability

Frequent reports

Goal setting tools

Educational tools

Personalized coaching

Encrypted payments

Trusted browsers

Introducing User Personas

These represent the core demographic and provide a deeper understanding of how PlutoPay will meet the needs of its users.

-

Renee is about to turn 40 and is starting to think about her future. She needs a plan that’s going to fit her lifestyle.Renee is looking for a personalized budget that can teach her some money-savvy habits, without making her feel like a penny-pincher!

-

MJ has just moved to a new city and is making the most of the nightlife with their new friends.They need a secure way to send payments to other users quickly and hassle-free

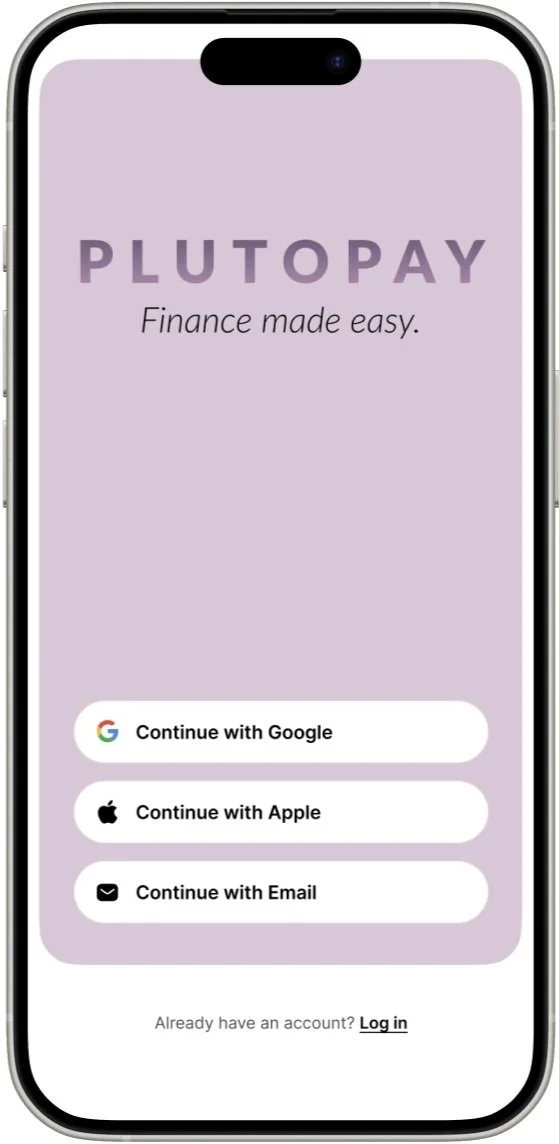

Ideate - Low-Fidelity

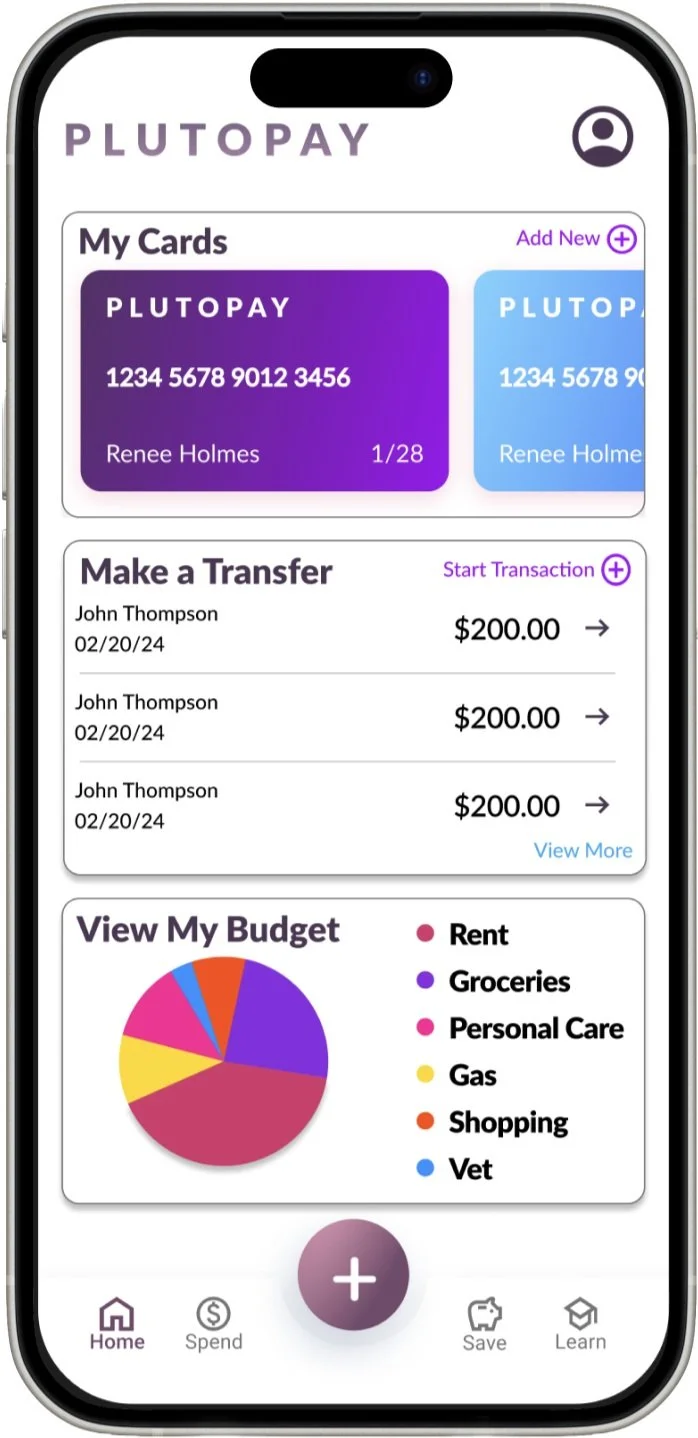

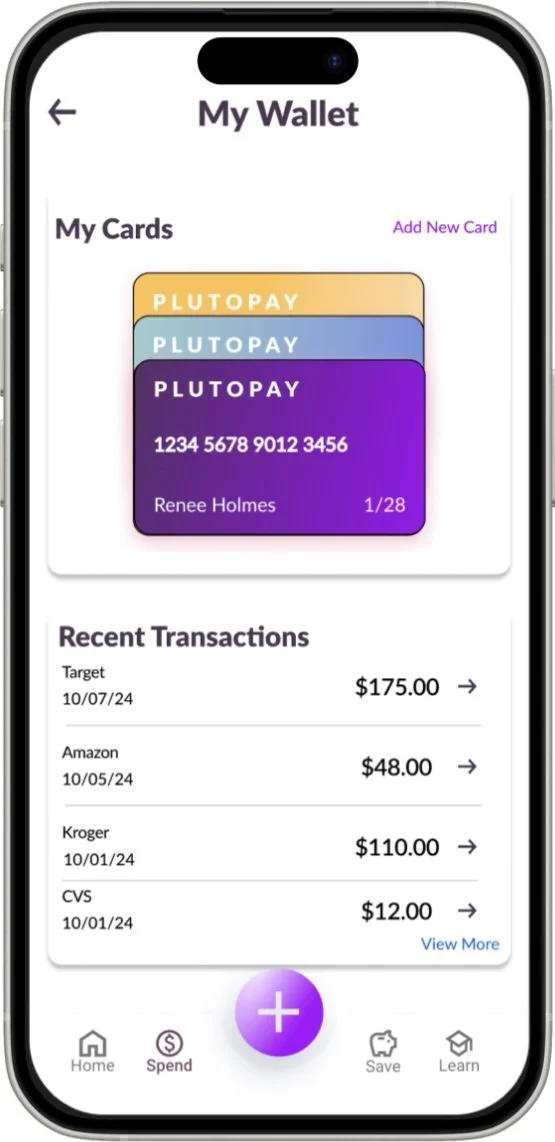

I built the initial wireframes for PlutoPay around a Dashboard that highlighted its main features: Budgeting, Money Transfers, and a Wallet to store cards. This allowed me to better understand the flow that users would experience through the app to find what they need.

Mid-Fidelity

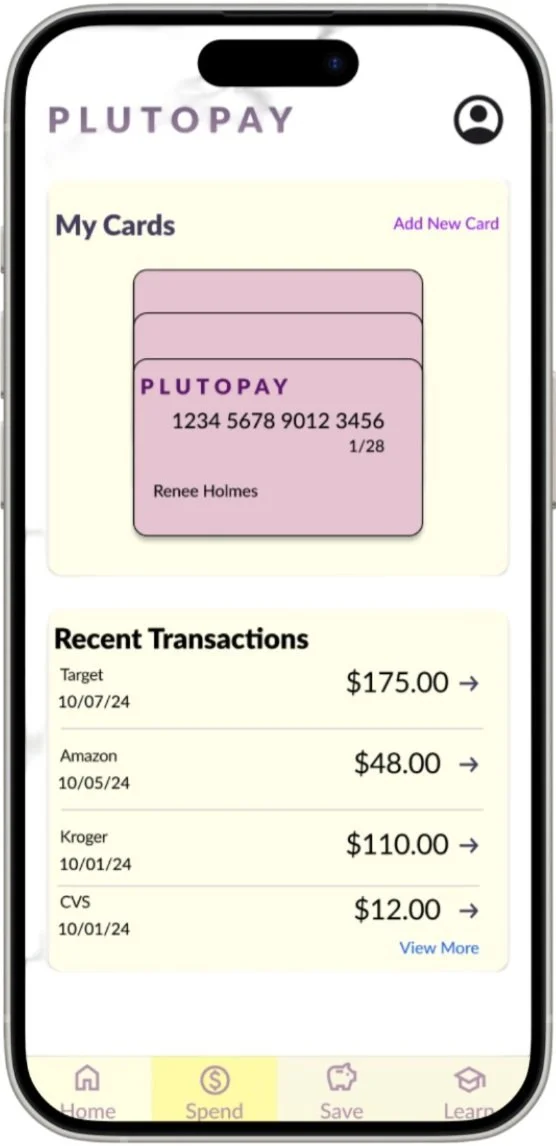

For the next iteration, I worked with my mentor to design a dashboard that would give users access to the most frequently used features right on the homepage. The focus here was on maintaining simple visuals while not making the user go through too many steps to get where they need.

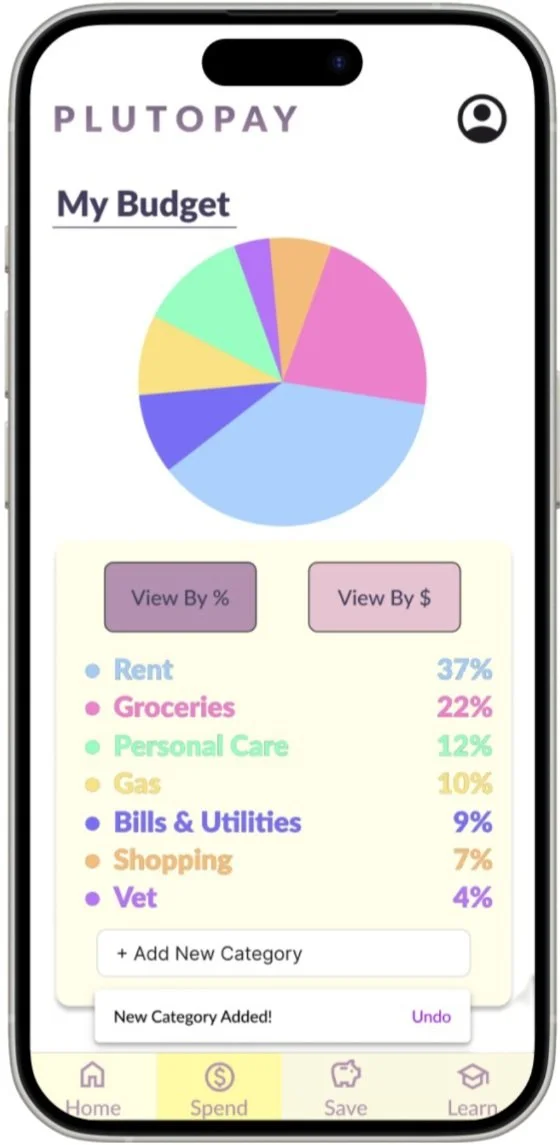

High-Fidelity

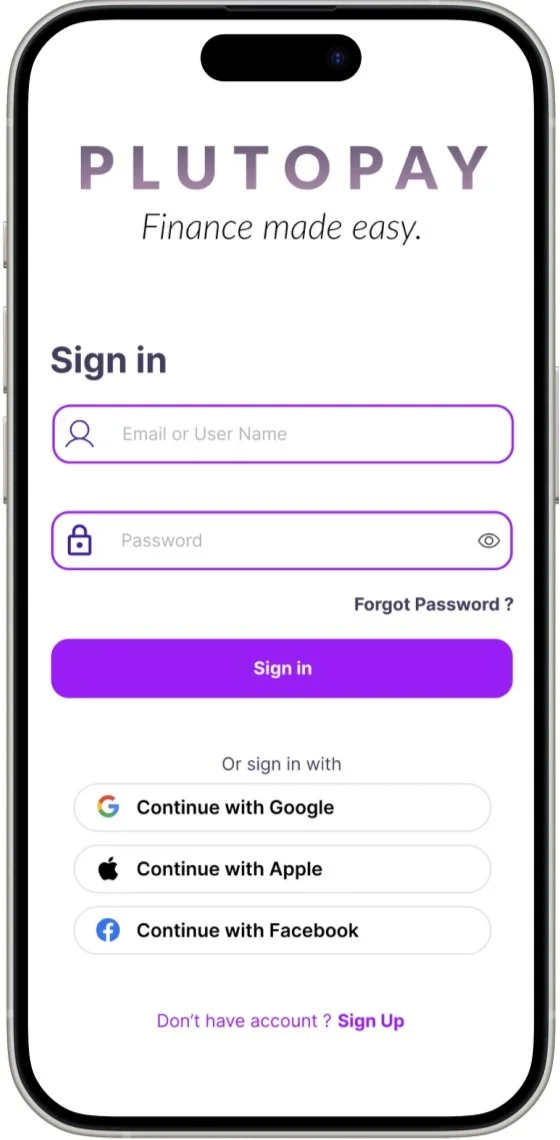

In the high-fidelity frames, I added details and color to bring the app to life. This prototype was used to perform the usability tests, which allowed me to gauge how users interact with the app based on colors, fonts, and other stylistic choices.

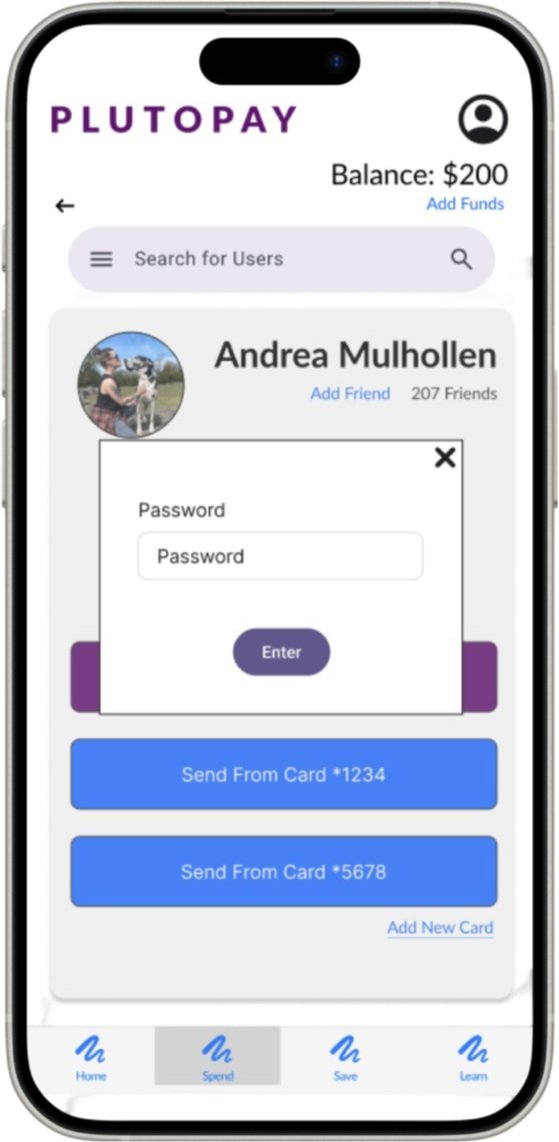

Validate - Usability Tests

Test Goal

To determine learnability for new users navigating through three simple features of the app:

Editing a budget

Sending a P2P transfer

Accessing a card in their wallet

Test Objectives

Determine if the app is intuitive to learn and navigate

Determine if the app builds trust in its users quickly

Determine if users believe this app could help them achieve their financial goals

Gain feedback on layout and aesthetics of the app

Test Methodology

In-person and remote moderated tests

Included a pre-test briefing and Informed Consent form, a computer task-based test, and a post-test briefing

Participant Demographics

6 participants

4 women, 2 men

Age Range: 25-64

User Positive Notes

Participants felt the app was similar to apps they’ve used, which improved their ease of use.

Participants were impressed with the many features offered on the Home Page.

Participants liked the color scheme and noted it was calming to look at.

User Errors

Participants 1-3 were unable to click “Start a Transaction.”

Participant 2 attempted to navigate through Scenario 1 several times and felt confused.

Participant 6 felt lost during the first 2 scenarios.

User Observations

Participants were interested in what information could be stored in the wallet.

Participants had varying opinions on FaceID and other preferred 2-Factor Authentications.

User Negative Notes

Participants felt frustrated by not being able to interact with certain elements that seemed intuitive.

Participants had trouble reading certain lines of text.

Participants wished they had been able to name their own category.

Preference Tests

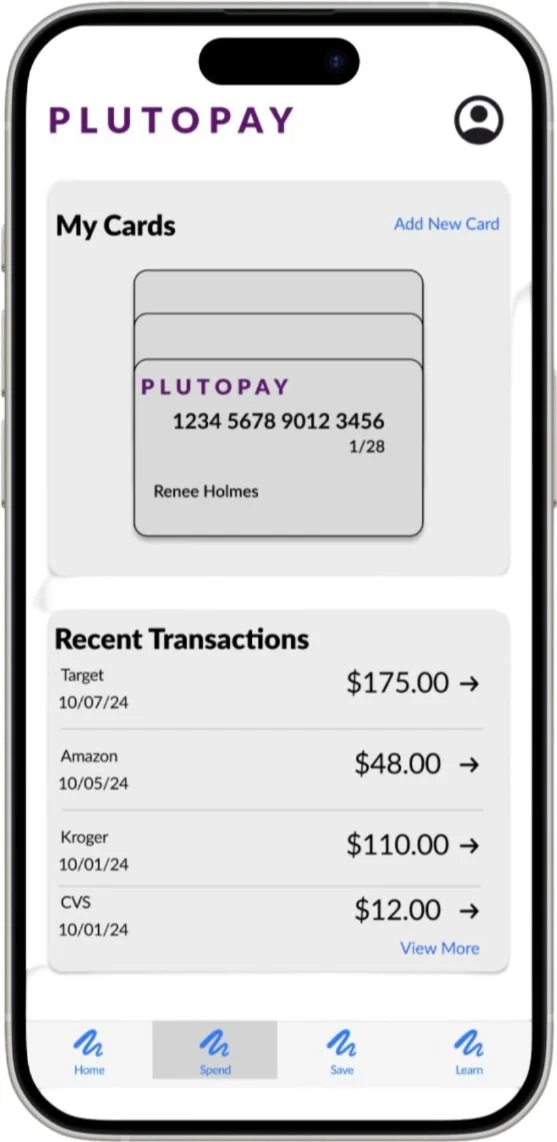

Iterate - Design System

Current Design

〰️

Current Design 〰️

By conducting thorough research, I have tailored PlutoPay’s functionalities to meet user needs as reflected in feedback from its core demographic. The current design of PlutoPay features a user-friendly interface with a clean layout, vibrant color palette, and seamless usability that promotes its brand identity. Intuitive navigation ensures users can effortlessly access its key features of: Budgeting, Transferring Money, and a Wallet to store cards securely. Accessibility remains at the forefront, making sure all users can navigate with ease and confidence to reach their financial literacy goals.

Next Steps

Goal-Setting

Hypothesis: Users are more likely to reach their financial goals with guided planning and visual goal-tracking. One of PlutoPay’s next features will include goal-setting capabilities powered with AI to create budgets, analyze spending, and provide users with updates on their progress.

DemoTrader

Hypothesis: Users feel more confident investing in a brokerage account after using a demo service to simulate trading. One of PlutoPay’s next features will include DemoTrader, a simulated brokerage account to educate users on investments without risking their own money.